Problem Statement

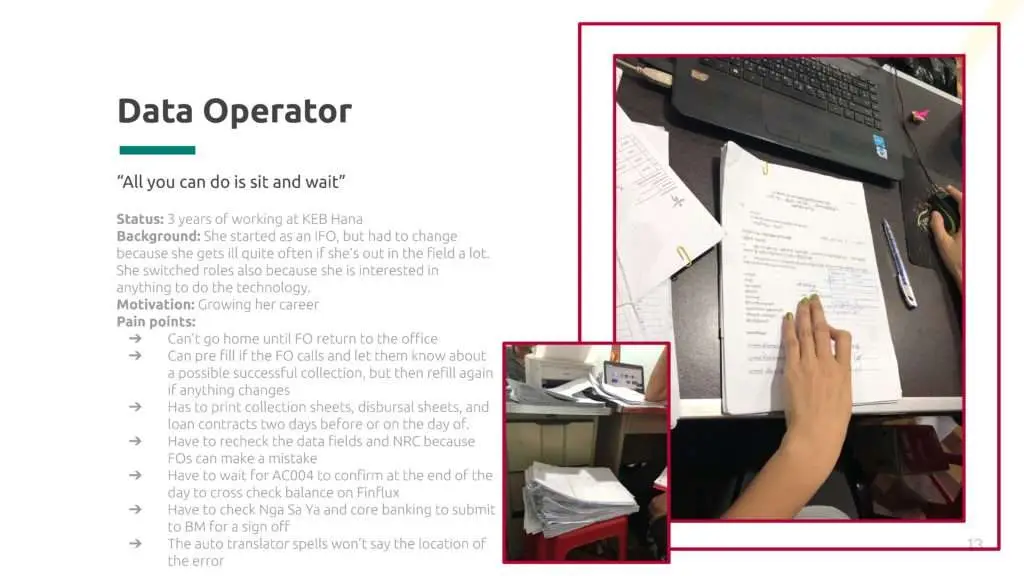

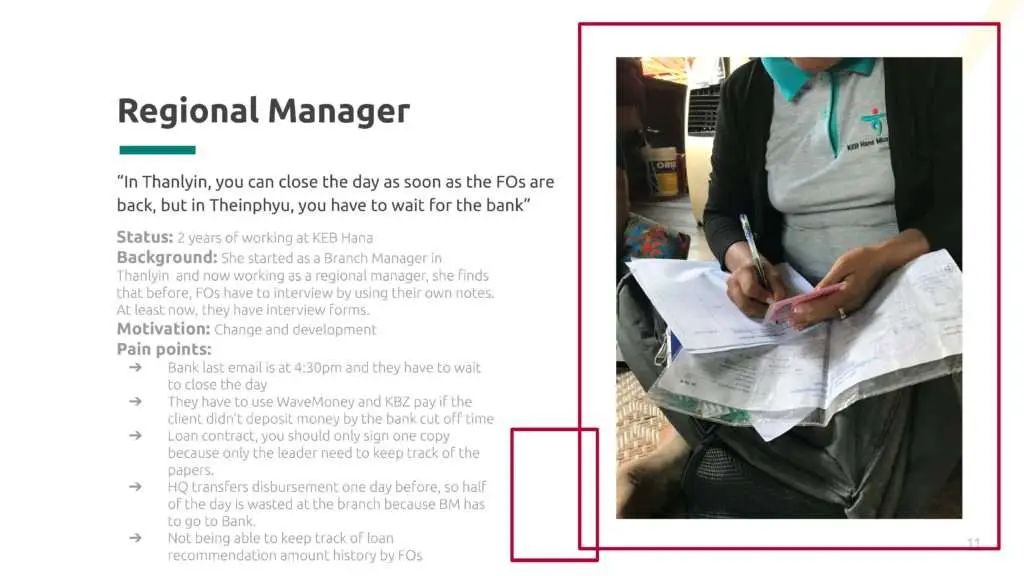

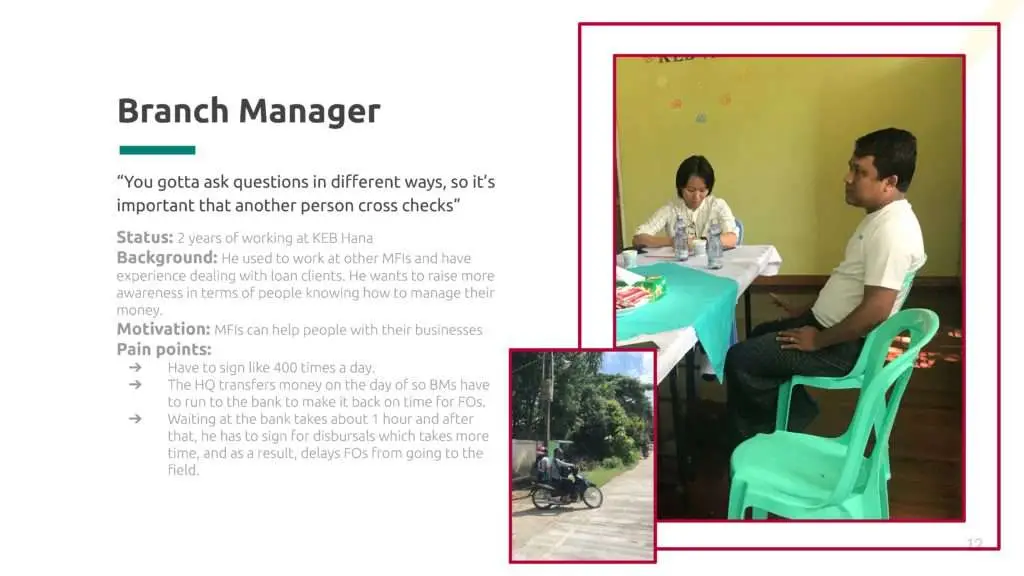

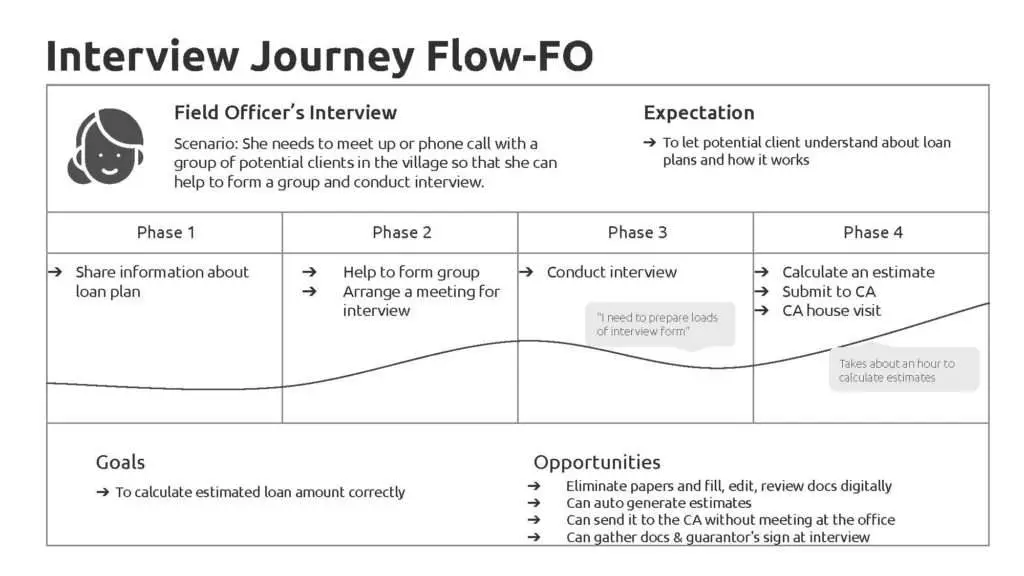

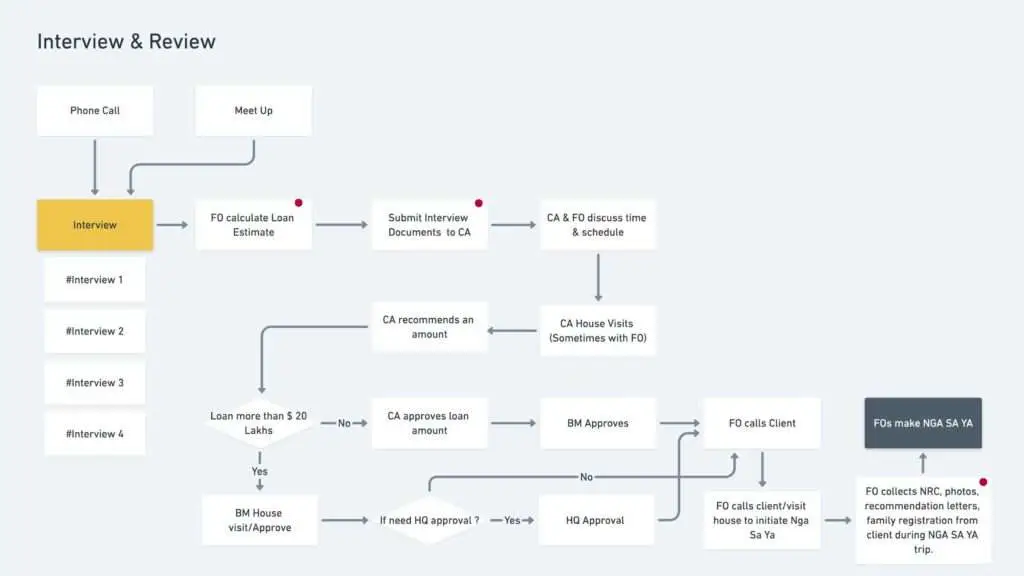

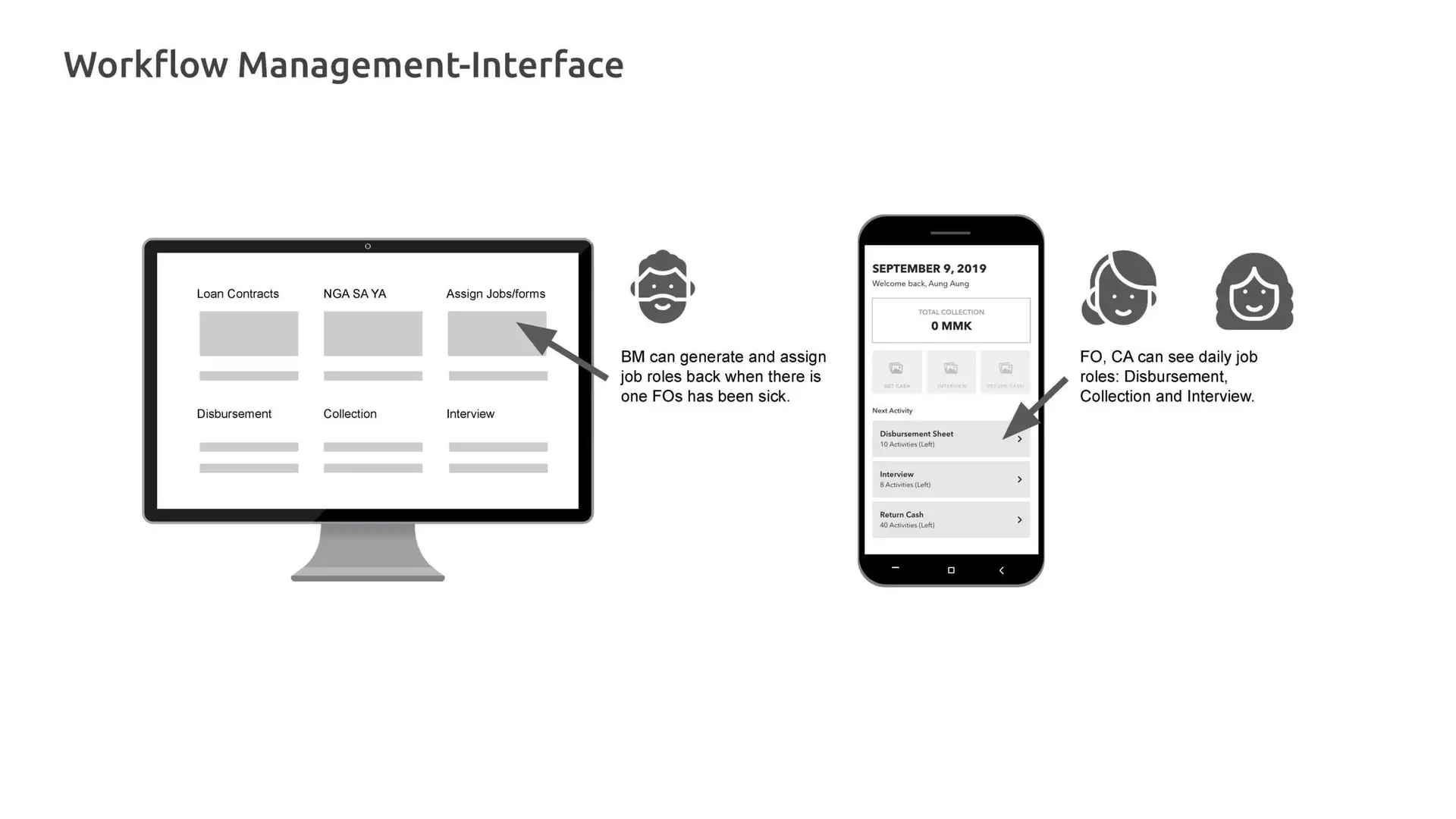

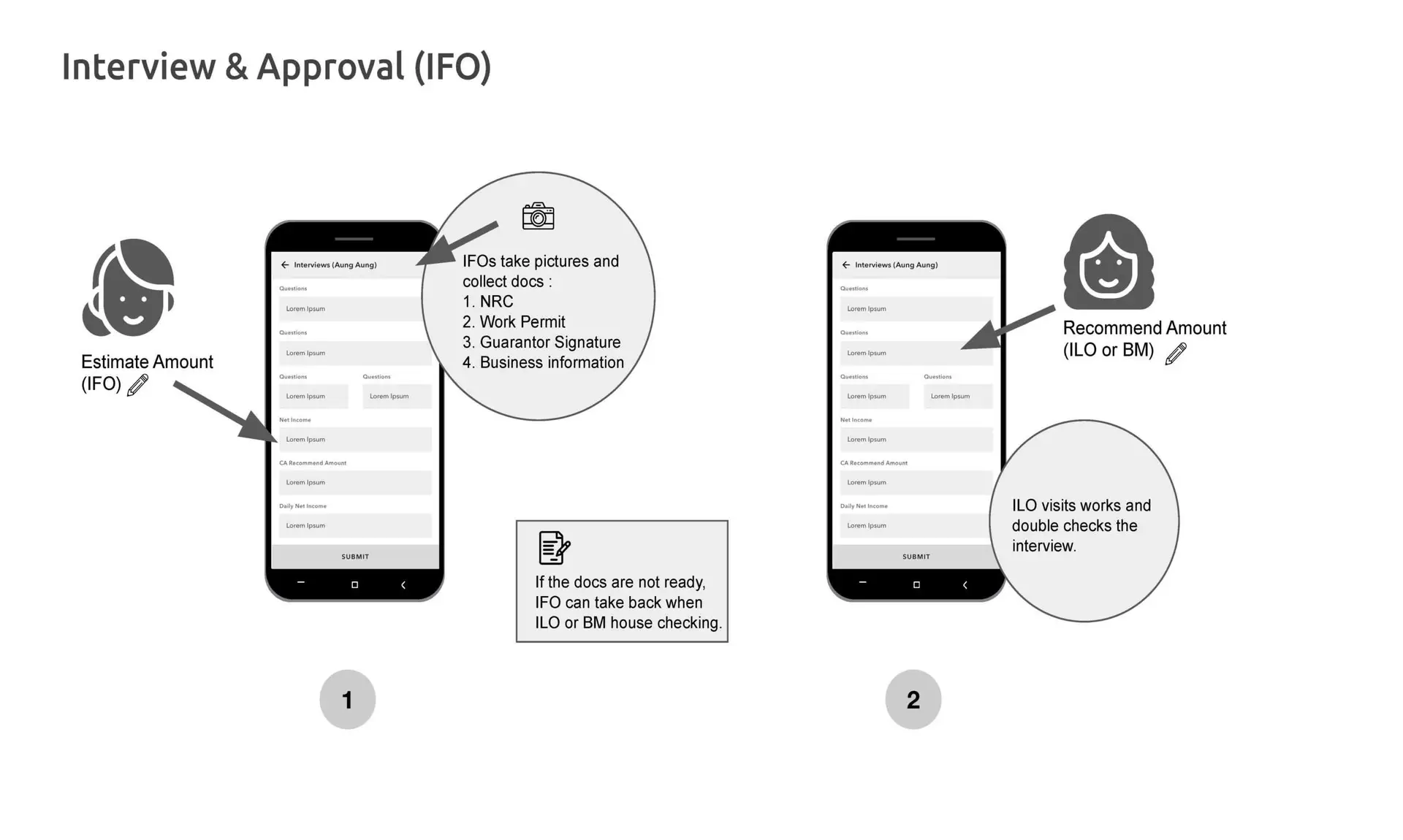

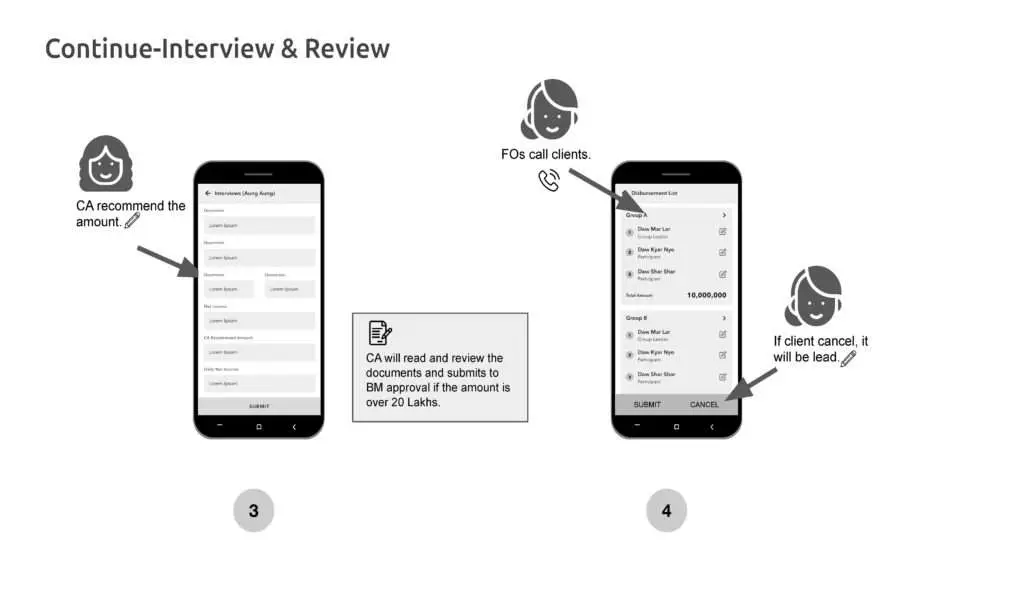

Most business operations relied on manual paper forms, resulting in frequent data entry errors and inefficiencies.

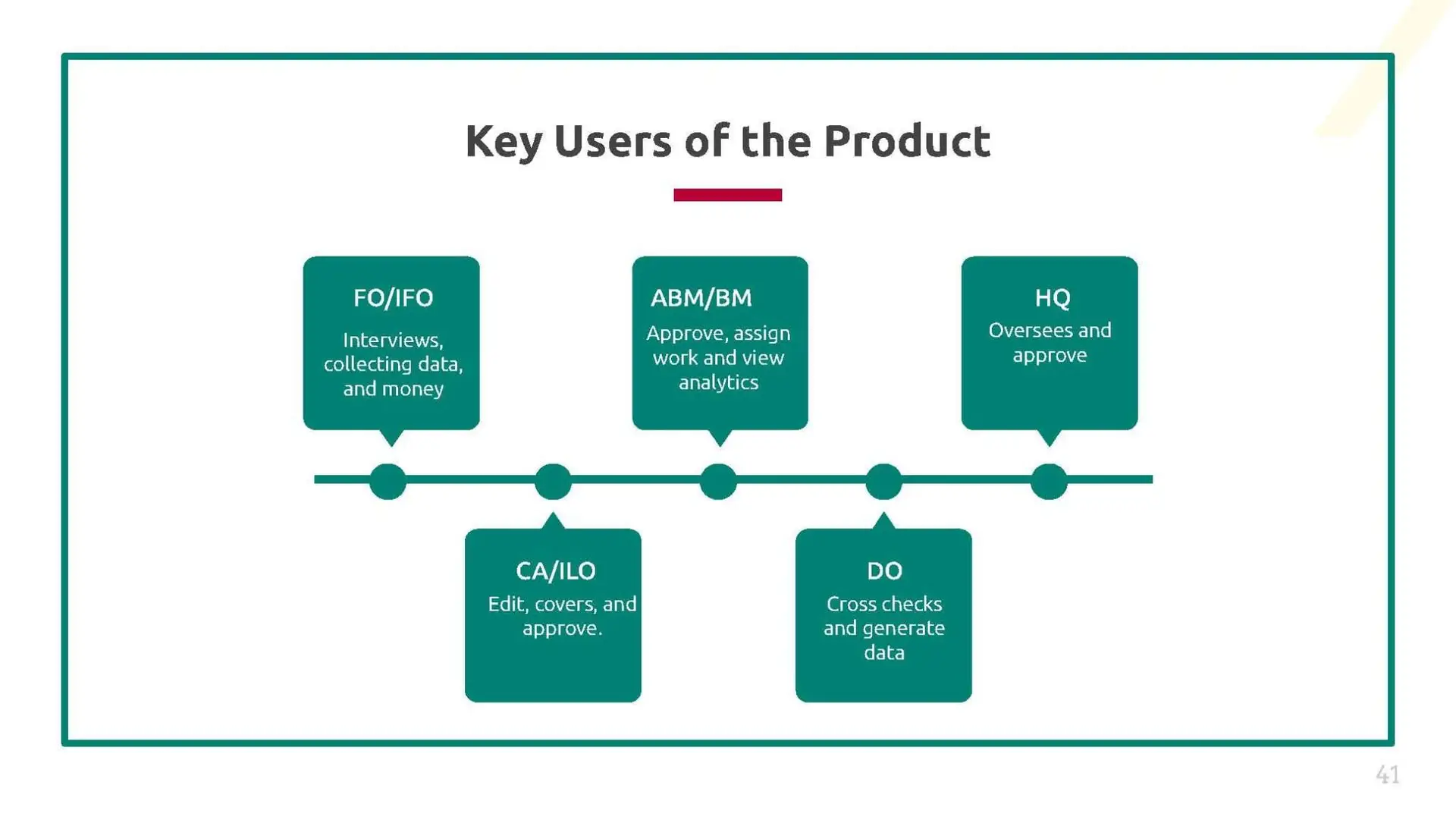

100% digital in their business operations, and to go paperless and to reduce human errors.

Aim

To drive a sustainable and scalable MFI by helping Myanmar people grow their own businesses.

Product Goal